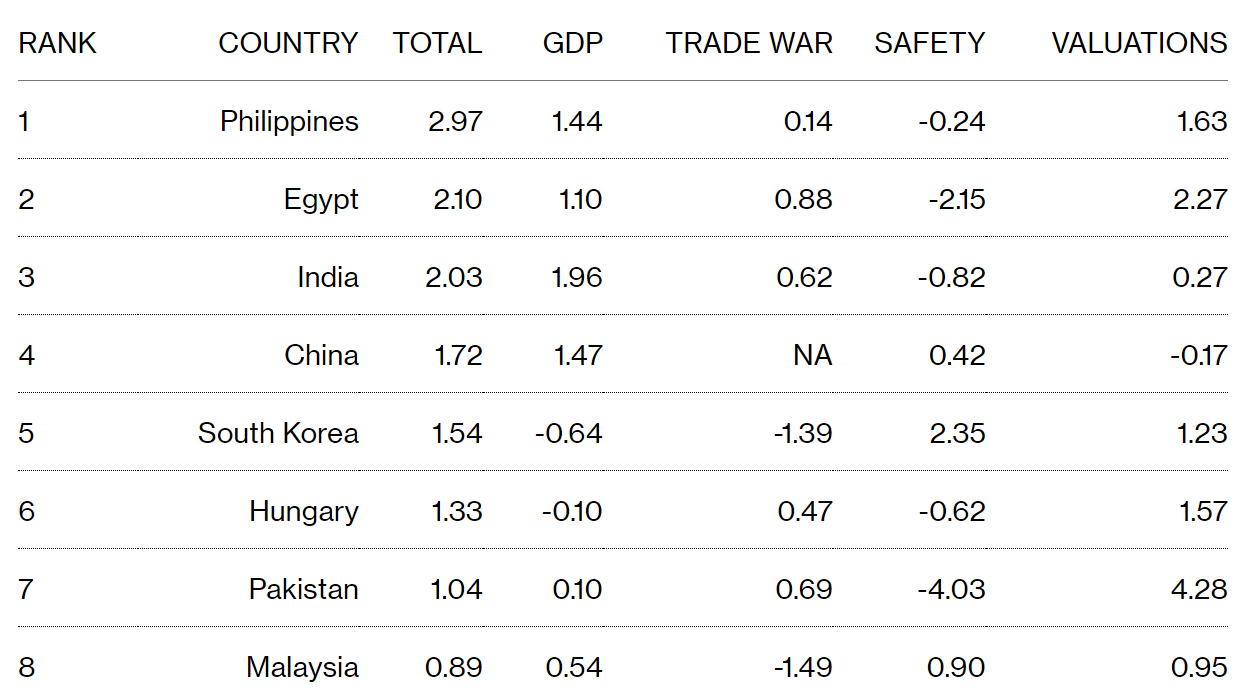

MANILA – The Philippines and Egypt have surfaced as the most resilient among emerging markets amid the trade-war angst, a Bloomberg analysis shows.

Most of the top-ranked countries have robust economic-growth outlooks, according to a Bloomberg scorecard of 21 developing economies. The Philippines and Egypt scored higher as recent sell-offs across developing markets have left their assets relatively undervalued. By contrast, Mexico, which now faces a fresh tariff threat from President Donald Trump, is at the bottom as the most vulnerable market due to its large exports to the U.S.

“The economies that have either strong domestic demand, smaller trade exposure to China or the U.S., or those with more restrictions for foreign investors to access the markets are more insulated,’’ said Satoru Matsumoto, Tokyo-based fund manager at Asset Management One Co., which oversees more than $500 billion. “It’s understandable that countries like Mexico that are more vulnerable to a U.S. slowdown and also traded as a proxy for emerging markets are ranking lower.”

Investors are scouring for emerging-market assets that still offer value following a sell-off triggered by a sudden escalation in trade war earlier this month. The MSCI Emerging Market Currency Index is set for its largest monthly drop since August, having fallen 1.3 percent in May. A gauge for EM stocks slid 7.5 percent after rising for the past four months.

Trade war impact is computed by taking a weighted average of each economy’s exports to the U.S. and China relative to nominal gross domestic product. China has no score for this criterion. Safety consists of current-account positions, sovereign credit ratings and foreign exchange reserves.

Valuations were computed based on price-to-earnings ratios for MSCI’s equity gauges, inflation-adjusted bond yields and real effective exchange rates.

For reserves, the economies that sufficiently meet the International Monetary Fund’s adequacy ratio get a zero score and those that fall short receive minus 1.

GDP growth and current account balances are from economist forecasts for 2019 and 2020 compiled by Bloomberg. Sovereign ratings are from S&P Global Ratings. Real effective exchange rates are based on JPMorgan Chase & Co. data. (Bloomberg)