12 May 2021, Manila, Philippines – From starting out as an e-wallet for making fast and secure online transactions to being the undisputed #1 mobile wallet app in the Philippines, GCash is now transforming itself once again to respond to the call of the times by launching new products and services to further its vision of making Filipino lives better everyday, with finance solutions made for all.

GCash as a platform has enabled Filipinos with digital finance which is easily accessible through their phones. With 1 in 3 Filipinos currently using the app after growing its user base from just more than 20 million in January 2020 to over 40 million to date, GCash is going beyond just providing seamless and secure transactions through cashless payments. This does not stop the leading mobile wallet to just be still and not look forward to the future. The organization has anchored its thrust towards building robust financial services offerings, extending the app capabilities to fit the lifestyle of its users, empower businesses and entrepreneurs across different enterprise sizes, and anchor the app’s ecosystem, partnerships, and capabilities to be a change agent and to commit to doing its part of nation-building.

With new financial and lifestyle services, GCash now allows its users to shop, save, invest, get insurance coverage, and more — all within the GCash app. That not only means having a more frictionless user experience and convenience for all, but more importantly, it means that many Filipinos will now have access to services that could help unlock a better everyday, and eventually, a brighter financial future.

“We want to make a real difference in the lives of every Filipino and break the existing boundaries to enable financial freedom. We envision a Philippines where people have equal access to financial opportunities and lifestyle choices, where everyone, whether rich or poor, has a chance to unlock and achieve their dreams,” shared Martha Sazon, President and Chief Executive Officer of GCash.

Unlock Your Financial Potential

GCash continues to stand by its commitment of making finance accessible to all with its 2021 suite of affordable products and services built to kickstart success for everyone.

Consumers can now unlock their life goals at any stage with GInvest, the new easy investment feature found in the GCash app that lets you invest for as low as P50 in professionally-managed local and global funds.

Amidst the pandemic, those who are looking for affordable coverage can turn to GInsure, where they can get insurance for medical emergencies such as Dengue, COVID-19, and accidents for as low as P300. With this, consumers can also get financial assistance via Cash For Medical Costs and the recently launched Cash For Income Loss due to any cause – all accessible through GInsure within the GCash app.

For easy money management, GSave is the fully digital, secure, and hassle-free savings account that was built in partnership with CIMB Bank, wherein the only requirement to start is an ID and a smartphone. It’s fully accessible once the account is created; and has no maintaining balance, no fees, and no initial deposit.

As a better alternative to high interest loans and borrowing money for emergencies, GCredit serves as a fully-verified user’s personal credit line within the App, with the ability to provide those with high GScores up to P30,000 credit line and up to 3% prorated interest rate; the earlier the due is paid, the lower the interest rate.

“At GCash we want to be able to democratize access to financial services,” shared JF Darre, Head of Financial Services and Advanced Analytics of GCash. “We aim to break down barriers of entry for Fillipinos and make them realize that saving, investing, or even insuring one’s finances can be accessible to all.”

Unlock a new lifestyle with GLife

With the aim to provide more than just convenience, GLife is an e-commerce feature within the GCash app that now allows users to shop and avail themselves of exclusive deals from a wide array of merchants including GOMO, Gong Cha, Kraver’s, McDonald’s, Puregold and PureGO, Lazada, Recess, Boozy, Bo’s Coffee, Mama Lou’s, GawinPH, KFC, Datablitz, Cherry Shop, Gameone, Goama Games, and more. Users and merchants alike can leverage the GCash payment system making it an easier e-commerce experience for everyone, and making GCash the new super life app.

“Accessible right from the GCash dashboard, you can already enjoy more than 35 brands across retail, food, gaming, entertainment and transport. And we have more coming every week that will surely cover all your lifestyle needs.” said Winsley Bangit, Chief Customer Officer of GCash.

Unlock The Entrepreneur in You with GCash QR on Demand

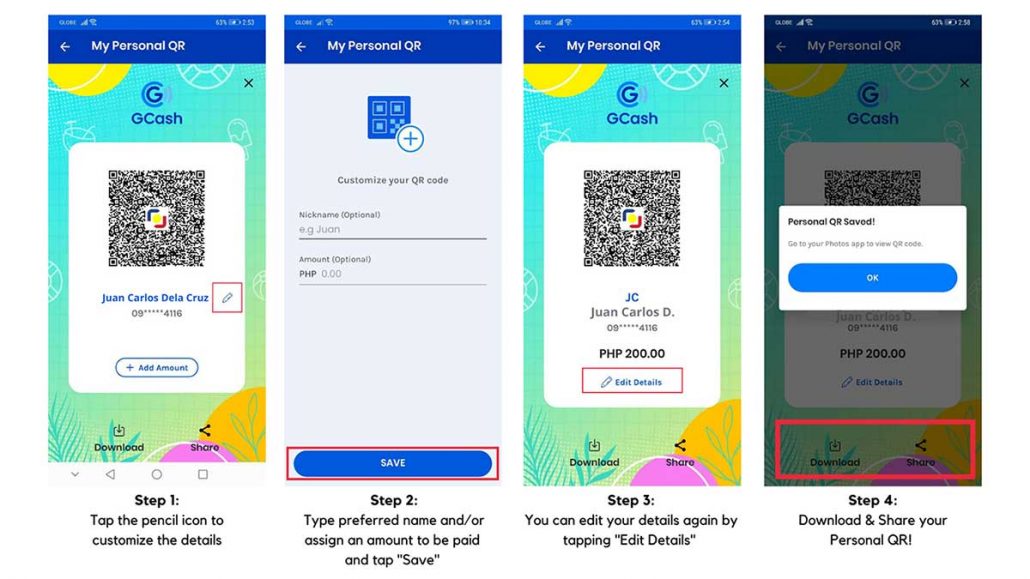

As part of its mission to help mobilize the economy and support all types of entrepreneurs, GCash introduces GCash QR on Demand: a new and better way to securely send and receive money without having to worry about “wrong sends” due to incorrect numbers, or giving away personal information such as their mobile numbers. Users can easily generate their own Personal QR and use this in place of giving their GCash number, for safe and hassle-free payments whether for personal use or for small businesses.

For fellow Filipinos abroad, GCash intends to aid and empower OFWs to take control of their finances by making the same products and services accessible to them. Every OFW with a verified account can now cash-in to his/her own GCash wallet via international remittance partners, and remit those funds instantly in the app. Through GCash’s upcoming GPadala service, OFWs can also send money to a non-GCash user for cash pick up anywhere in the country.

“We have great ambition for 2021 for MSMEs and Filipinos in every corner of the globe; we know how this whole sector will be more critical than ever for our economy, and GCash can make a real difference in this sensitive situation. People need it. The country needs it.” shared Fred Levy, Chief Commercial Officer of GCash.

Unlock Social Impact

As part of its holistic sustainability agenda for 2021-2025, GCash is one with the nation as it aligns itself with the UN’s Sustainable Development Goals. This includes pursuing efforts beyond business results such as helping make financial literacy and education accessible for all.

Plans to make this happen include the Kaya Mo, GCash Mo Roadshow, the design and roll-out of Future-Ready Hackathons, and the launch of G NA! IDEAS Para Sa Pinas. This 2021, GCash continues to pursue collaborations to achieve even bigger things with efforts like GCash For Good and the GForest platform.

“At the end of the day, we will all go back to our core purpose— to help one another in times of need and indeed unlock our desired impact on the society as a whole,” said Chito Maniago, GCash’s Vice President of Corporate Communications and Public Affairs.

GCash is all about breaking existing boundaries through efforts to democratize access to financial opportunities and lifestyle choices, while making sure that all these innovations and initiatives lead to a better and healthier community for all.

###

GCash is the leading mobile wallet in the Philippines. Through the GCash app, customers can easily buy load; pay bills at over 400 partner billers in the app; pay at more than 7,000 online partners; send and receive money anywhere in the Philippines; pay using QR codes at over 130,000 partner merchants nationwide; save money while earning interest; and invest money at local and global funds — all through the convenience of their smartphones.

Globe Fintech Innovations Inc. (Mynt), which operates GCash, is part of the portfolio companies of 917Ventures, the largest corporate incubator in the Philippines wholly-owned by Globe Telecom, Inc.

MEDIA CONTACT

Van Minoza

PR and Media Relations Manager

APEX PR, Events, and Marketing Solutions

van@apexprandevents.com

0927 009 0700

APPENDIX

PRODUCT DETAILS

GInvest: Unlock Your Life Goals At Any Stage

- GInvest is one of the in-app financial products that allows Filipinos to invest for as low as P50. With the help of international Asset Managers and GCash’s partners in ATRAM, people can now choose from 5 different funds, ranging from local or global funds to invest in depending on their investment strategy.

- With GInvest, GCash aims to break the common barriers and make investing easier, less intimidating, and always accessible for all. Users of GInvest will be able to view the past 1 year return of the fund they’ve selected, monitor the movement of the fund in the charts displayed, track their transactions as they’re processed, and check on the value of their investments in real-time.

GInsure: Protection and Peace Of Mind For All

- GInsure is the convenient and affordable solution to help Filipinos make their money work for them while protecting themselves and their families amidst uncertainty. Through its partnership with Singlife, users will be able to avail themselves of insurance that protects them from the costs of medical emergencies such as COVID-19, Dengue, and accidents, for as low as P300, with benefits stretching up to as high as half a million pesos per person.

- Wth GInsure, users will also be able to avail themselves of products such as Cash for Medical Costs, which covers medical costs beyond just COVID-19 and Dengue including terminal illnesses; and the recently launched Cash for Income Loss due to any cause, which essentially gives Filipino families a safety net in case their breadwinner is unable to work due to an unforeseen reason. Today, over 100,000 Filipinos are already protected by GInsure.

GSave: Master Your Money, Grow Your Funds

- Insured by PDIC, GSave is the fully digital, secure, and hassle-free savings account that was built in partnership with CIMB Bank, wherein the only requirement to start is an ID and a smartphone. It’s fully accessible once the account is created; and has no maintaining balance, no fees, and no initial deposit. With GSave, users can enjoy an annual interest rate of up to 4%一one of the highest interest rates in the country compared to local banks. To help users make the process of saving more seamless, there is an auto-deposit function that lets them schedule periodic deposits to their GSave account, provided that they have sufficient GCash balance at the time of the scheduled auto-deposit.

GCredit: Budget Support With No Strings Attached

- According to statistics, more than ⅓ of Filipinos are unable to meet regular spending needs resulting in availing of loans or borrowing money from family and friends for emergencies. Because of this, GCash now introduces GCredit.

- GCredit serves as a fully verified user’s personal credit line within the App, with the ability to provide those with high GScores up to P30,000 credit line and up to 3% prorated interest rate; the earlier the due is paid, the lower the interest rate. Users can increase their GScore through timely payments of GCredit dues, usage of other in-app financial products and services such as GSave and GInvest, or by using GCredit to Pay QR and Pay Bills.

GLife: Seamlessly Switch from Pay-time to Playtime

- There is no need to install extra apps on the smartphone to access on-demand products and services. With just a few taps, users can easily browse through over 30 different restaurants, lifestyle brands, and essential services with more coming every week; and pay for them effortlessly through fast and secure online transactions.

- Partner brands can reach a wide audience and speak to millions of potential customers within the GCash app while keeping their visual brand identity intact through a flexible and customizable interface design.

GCash QR on Demand: The New and Better Way To Send and Receive Money

- Allows users to securely send and receive money without having to worry about “wrong sends” due to incorrect numbers, or giving away personal information such as their mobile numbers. Users can easily generate their own Personalized QR code and use this in place of giving their GCash number — perfect for either small businesses or personal use.

- How To Generate and Customize Your Own Personal QR:

GCash Now Made Accessible For OFWs

- With a verified account, every OFW can now cash-in to his/her own GCash wallet via our international remittance partners. They can then remit those funds instantly in the app via a P2P transaction, send money to a PH Bank account in real time, or very soon, through our upcoming G-Padala service, send money to a non-GCash user for cash pick up anywhere in the country making it easier for Filipinos overseas to manage and have better control over remittances sent back home.

GCash and Unlocking Social Impact

- CSR efforts of GCash in partnership with CHED, tertiary education institutions, and the National Youth Commission to promote financial literacy

- This includes plans to work closely with existing partners including BSP, DTI, and GoNegosyo to launch high-impact and creative programs to make learning about finance easier and more approachable while reaching as many Filipinos as possible.

Kaya Mo, GCash Mo Roadshow

- An easy and interactive approach to financial literacy that maximizes social media platforms through talk shows with influencers and KOLs, and robust learning materials like coloring books, e-Komiks, sari sari store collaterals, and games.

Future-Ready Hackathons

- One of the GCash Social Impact projects that aims to help identify pressing social problems and implement viable solutions to address these problems. Winners of the hackathon will be recognized through the GCash Innov8 Awards.

G NA! IDEAS Para Sa Pinas

- A virtual ideation competition for netizens where they brainstorm and propose what they can offer in terms of sustainability, with focuses on education, innovation, and inclusion.

GCash For Good

- A community initiative done in partnership with NGOs to help provide aid during different crisis situations

GForest

- An environmental protection feature that transforms the GCash app into a platform where users can collect enough green energy to plant virtual trees.

- When users plant a virtual tree, GCash then plants a real tree — which users may select within the app — in designated areas like the Ipo Watershed.