STATE-run Land Bank of the Philippines (LANDBANK) reported that a total of 2,481,788 unbanked Philippine Identification System (PhilSys) registrants have already signed up for LANDBANK transaction accounts as of April 30, 2021.

This forms part of LANDBANK’s partnership with the Philippine Statistics Authority (PSA) to co-locate during the PhilSys Step 2 registration and provide unbanked registrants with their transaction accounts.

Of the total 2,481,788 unbanked registrants, the Bank already issued LANDBANK Agent Banking Cards (ABCs) to 850,875 of them – free-of-charge and without an initial deposit requirement – while the rest will receive their cards by July.

Upon the invitation of National Economic and Development Authority secretary Karl Kendrick Chua to co-locate with the PSA, LANDBANK aims to bank at least one household member of the estimated 18 million low-income households applying for the National ID and provide them access to basic banking services and emergency government subsidies.

Previously, the PSA reported that 82 percent of the 10.52 million initial registrants do not have formal bank accounts.

“LANDBANK is one with the National Government’s financial inclusion agenda. In partnership with the PSA, we are focused on opening accounts for up to eight million low-income, unbanked individuals from the 32 PhilSys priority provinces at the soonest time,” said LANDBANK president and chief executive officer Cecilia Borromeo.

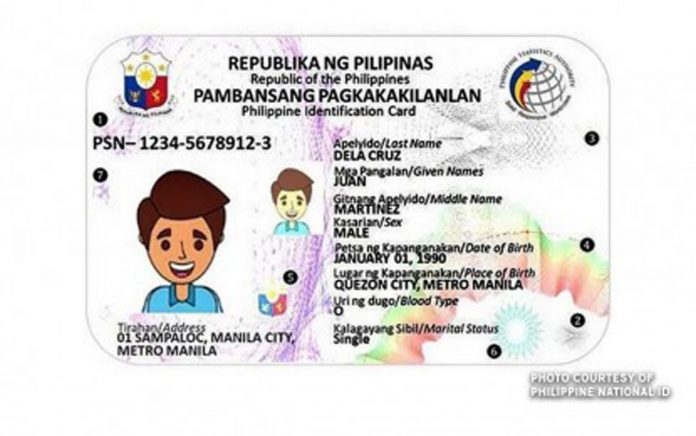

Unbanked PhilSys registrants can avail of LANDBANK transaction accounts once they have completed the second step of the registration, which covers the validation of supporting documents and capturing of biometrics information.

LANDBANK ABCs are given to unbanked PhilSys registrants free-of-charge and with no initial deposit requirement through LANDBANK account opening booths at designated co-location areas.

Cardholders can use the LANDBANK ABCs to cash in, cash out, and transfer funds at any LANDBANK Branch or Agent Banking Partner. They can also withdraw cash at Mastercard-accepting ATMs, perform cashless transactions, shop online, as well as receive government subsidy digitally.

Soon, the LANDBANK ABCs can also be used as contactless cards to pay fares in public transport modes under the Automatic Fare Collection System project of the Department of Transportation.

LANDBANK is tapping personnel from its eight Branches Groups nationwide, as well as accredited cooperatives, associations, small and medium enterprises, and private entities as Agent Banking Partners, to assist in the account application and Know-Your-Customer requirements at the registration sites.

As of April 30, 2021, LANDBANK has co-located in 790 PhilSys Registration Centers in 10 regions, with additional centers in the pipeline as registrations continue to take place in 32 priority provinces nationwide./PN