MANILA – The construction sector is up for a rally in 2019 and 2020 as the Duterte administration’s flagship Metro Manila subway project will boost construction activities in the country, think tank Fitch Solutions Macro Research said Friday.

Fitch Solutions noted “relative political stability, a healthy project pipeline, and growing foreign direct investments are factors supporting our positive outlook for Philippine transport sector in the next five years.”

The affiliate of Fitch Ratings sees the construction sector growing by 10.9 percent in 2019 and 10.5 percent in 2020. Its view is part of its outlook for the Philippines’ construction industry.

“We currently hold a positive outlook for the Philippine transport sector in the next five years. We believe relative political stability within the country will be a plus for the sector as policies enacted by the current government will benefit from continuity over the next few years.”

It is forecasting the railway sector to grow by 9.1 percent and 8.6 percent in 2019 and 2020, respectively.

“Growth of the Philippines’ construction sector will be boosted by positive progress made on Phase I of Metro Manila subway project,” it said.

“The project, the largest of President Rodrigo Duterte’s ‘Build Build Build’ infrastructure program, is partially financed by a $985-million loan disbursed by Japan International Cooperation Agency and construction is expected to commence in first quarter 2019,” it added.

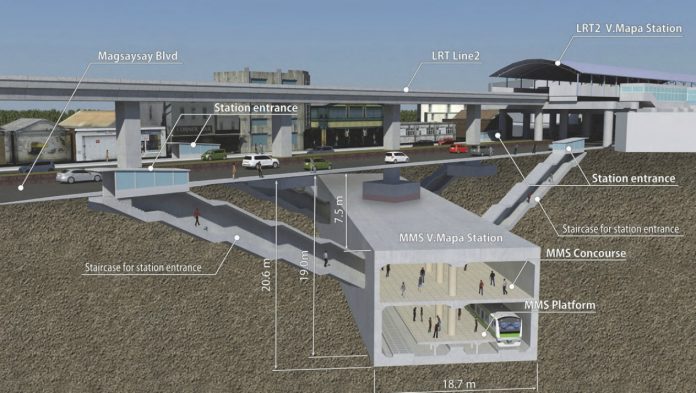

The 25-kilometer long subway system will run from Mindanao Avenue in Quezon City to the Manila International Airport, linking key districts within Metro Manila. It is envisioned to alleviate traffic congestion once completed in 2025.

The country’s healthy project pipeline lends support to its positive outlook that is underpinned by political stability, according to Fitch Solutions

Major infra projects

Apart from the Metro Manila subway project, it cited the Bulacan Airport, Makati Subway, and Metro Cebu Expressway as major infrastructure projects that will boost the construction and transportation sector.

“Public-Private Partnerships (PPPs) will be an important tool for the procurement of transport projects in the Philippines,” the think tank said.

“Given tight government budgets and an increasing demand for transport infrastructure, PPPs will be used to attract private capital into the sector,” it said.

“The transport sector will be exposed to a smaller degree of political and election risks in the short term as President Rodrigo Duterte is only slated to step down after the 2022 general elections,” Fitch Solutions noted.

A large pipeline of transport projects spans across different sub-sectors, based on Fitch Solutions’ Projects Database. It said there are 64 transportation projects in the pre-construction phase, accounting for more than 75 percent of the total value of construction projects in the pipeline.

Since Duterte’s appointment as President in 2016, he has eased ownership restrictions for foreign contractors in selected construction projects from 25 percent to 40 percent in a bid to improve the country’s competitiveness, according to the think tank.

“Also, we note that the amount of foreign direct investments in the construction industry has increased, reflecting the administration’s fruitful efforts in attracting foreign capital to the sector to support the ‘Build, Build, Build’ program.”

These efforts will have a positive effect on the sector long-term as easing restrictions will make the country a more attractive destination for foreign investment and this will encourage more inflows of foreign capital, Fitch Solutions noted.

This translates to a larger pool of funding to plug the expanding financing gap in the transport sector.

“Japan has traditionally been one of the largest sources of foreign direct investment and we now expect more Chinese capital to flow into the country to support growth of the overall infrastructure sector,” Fitch Solutions said. (GMA News)