State-owned Development Bank of the Philippines (DBP) celebrates its 78th anniversary this year buoyed by the prospects of a new Charter that would enable it to adapt to the fast-changing financial landscape and better serve its clients.

The 10th largest bank in terms of assets, DBP is designated as the country’s Infrastructure Bank and provides funding assistance to projects in four key economic sectors — infrastructure and logistics; micro, small and medium enterprises; social services and community services; and the environment.

Founded as the Rehabilitation Finance Corporation in 1947, it was renamed the Development Bank of the Philippines in 1958 to mark the strategic shift in rehabilitation financing to broader banking activities.

DBP’s charter was last amended in 1998 through Republic Act No. 8523, which raised the bank’s authorized capital stock from P5-billion to P35-billion.

With a new charter, the authorized capital stock of DBP will increase from the current P35-billion to P300-billion and more importantly, allow it to broaden its credit assistance to priority sectors and expand its menu of financial products and services.

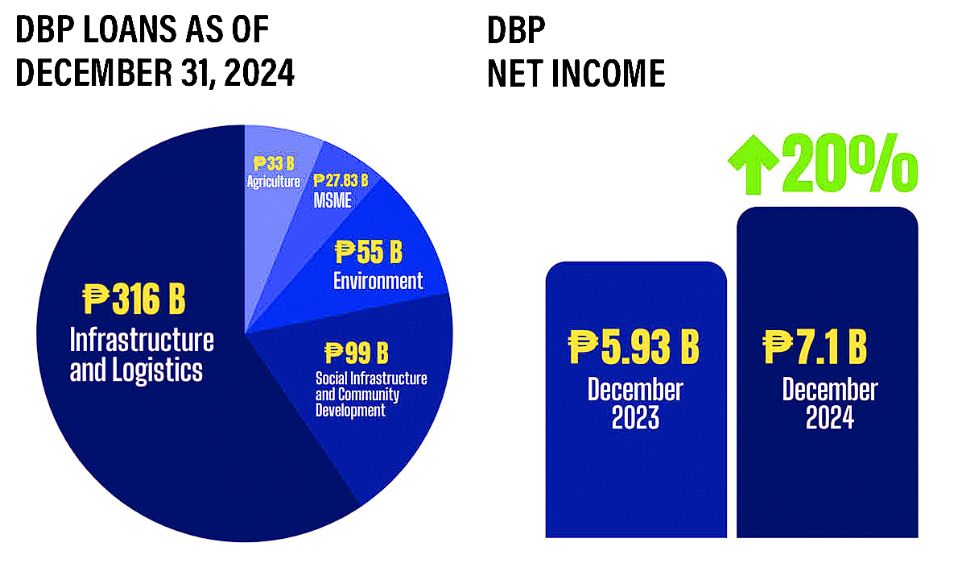

In 2024, DBP’s net income jumped to P7.1-billion, which is unprecedented for the past 10 years and representing a 20% increase year-on-year as the Bank ramped up its lending activities to key economic sectors in support of the Marcos, Jr. Administration’s socio-economic agenda.

DBP’s total loans to borrowers as December 31, 2024 also stood at P536-billion, with 61% of it allotted to the infrastructure and logistics sector with P326.5-billion. Other sectors that received DBP funding assistance include social infrastructure and community development with P99-billion, environment with P51.5-billion, agriculture with P33-billion, and micro, small, and medium enterprises with P27-billion.

STRENGTHENING PARTNERSHIPS

In 2024, DBP strengthened its partnerships with various local government units (LGUs) and other government institutions as part of its strategy of promoting sustainable socio-economic growth, particularly in the countryside.

It approved a P300-million loan to finance the City Government of Ormoc’s site and land development in support of the Pambansang Pabahay Para sa Pilipino (4PH), the flagship national shelter program of President Ferdinand R. Marcos, Jr.

The loan will finance the construction of two four-storey buildings consisting of 96 housing units each that will benefit qualified low-income families as well as those who are still living in government-owned properties.

The financing assistance is the maiden approval under the DBP Credit Facility for the 4PH Program (BAHAY-4PH) which is specifically designed to provide financing through development loans to LGUs, housing developers and contractors participating as project proponents in the 4PH Program.

MORE CONVENIENT LOCATIONS

DBP has also moved several of its offices to more strategic locations as part of its continuing efforts to make its customer touchpoints more accessible to the public.

DBP P. Tuazon Branch, formerly the DBP Camp Aguinaldo Branch, has transferred to the corner of P. Tuazon Boulevard and Lakandula Street in Quezon City. Meanwhile, DBP Sta. Cruz Branch is now poised to make DBP more accessible to residents of the provincial capital as well as nearby towns in the eastern portion of Laguna.

The Bank also inaugurated a new building in Iloilo City. Located along I. Dela Rama Street, it houses both the DBP Iloilo Branch and DBP Iloilo Lending Center and mirrors the Bank’s commitment to help spur economic growth not only in the city but the entire province.

DBP has a branch network of 149 full-fledged branches and branch lite units, most of which are in underserved and unbanked areas of the country.

SUSTAINABILITY AND GOVERNANCE

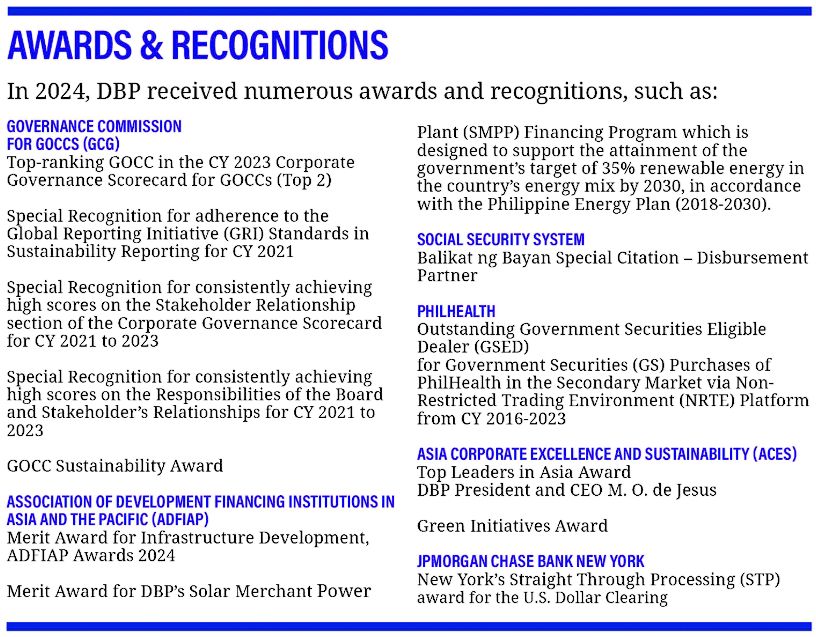

DBP was also recently honored for scoring the second highest ranking in the Corporate Governance Scorecard (CGS) of the Governance Commission for GOCCs (GCG) with an above ceiling score of 102.67%.

It likewise received GCG special awards such as the GOCCs for Sustainability Award, Special Recognitions for consistent high scores in CGS ratings under the categories of Responsibilities of the Board and Stakeholder Relationships for 2021 to 2023, and Special Recognition for adherence to the Global Reporting Initiative (GRI).

Meanwhile, DBP received the “Green Initiatives Award” for spearheading sustainability efforts in the local banking industry in the Asia Corporate Excellence and Sustainability (ACES) Awards 2024 organized by Malaysia-based MORS Group.

The Green Initiatives Award conferred to DBP during awarding rites in Bangkok, Thailand cited the Bank’s successful integration of sustainability practices into its policies and operations as well as for its pioneering adoption of green practices that started as early as the 1990s.